Albert Cuesta, Journalist

European telecommunications are going through a delicate period, as was made clear in the joint intervention by the four major European operators at the Mobile World Congress (MWC24) at the end of February. The positive note is that data consumption, both in fixed-line and mobile telephony, is continuously and significantly increasing worldwide, with the added billing potential that this may result in. However, this requires operators to also increase their annual investment to meet the growing demand and technological evolution of telecommunications networks.

The constant investment in telecommunications networks is, however, difficult to monetise, especially for European operators, as they are subject to relatively small and highly regulated national markets, with declining tariffs and a brutal increase in competition, as new low-cost brands continually emerge, many of which are owned by the dominant operators themselves, as well as virtual operators, competing for customers among themselves.

The relatively low profitability of European operators leads to, among other adverse effects, very low stock market valuations and greater difficulty in obtaining external financing. This is contrasting the major US and Japanese operators, which, despite facing strong internal competition, can weather the situation with tariffs two to three times higher than their European counterparts, as highlighted by various studies.

The case of Deutsche Telekom, the dominant German operator, is paradoxical: it earns strong profits because it owns the majority of shares in its US subsidiary, T-Mobile US, which competes with Sprint and AT&T, but achieves much weaker results in its domestic market, Germany. For example, Alphabet’s market capitalization, Google’s parent company, is now around $1.75 trillion, ten times more than the sum of the market capitalizations of the four largest European operators by subscriber numbers (Deutsche Telekom, Vodafone, Orange, and Telefónica). Microsoft has just surpassed the $3 trillion mark in market capitalization, buoyed by the sale of various telecommunications services.

European operators invested a record €59.1 billion in 2022, up from €56.3 billion the previous year. According to the “State of Digital Communications 2024” report published on January 29th by the European Telecommunications Network Operators’ Association (ETNO) and prepared by the North American consulting firm Analysis Mason, six out of ten Europeans had access to fiber optic cable (FTTH) by the end of last year. Gigabit fixed network coverage in Europe was 79.5% by the end of 2023, and 5G network coverage reached 80% of the population, up from 73% the previous year, as stated in the report.

The thesis of the European operators association’s report is that innovative connectivity is crucial for the competitiveness and security of the European continent. Therefore, operators are increasingly investing in expanding and upgrading fixed and mobile networks and responding to user demands for more ubiquitous and faster connectivity. However, Lisa Fuhr, ETNO’s director-general, asserts that the situation is unsustainable, and Europe now faces a dilemma between “leading or losing” its connectivity ecosystem.

“The current status quo, in terms of investment and regulatory policy, will not achieve the levels of innovation that are desperately needed to sustain growth and achieve the necessary open European strategic autonomy,” Fuhr adds. For ETNO, European Union telecommunications are at a critical juncture, needing urgent political action to strengthen the European telecommunications sector and achieve the objectives of the Digital Decade Policy Programme 2030.

Average revenue per user very low

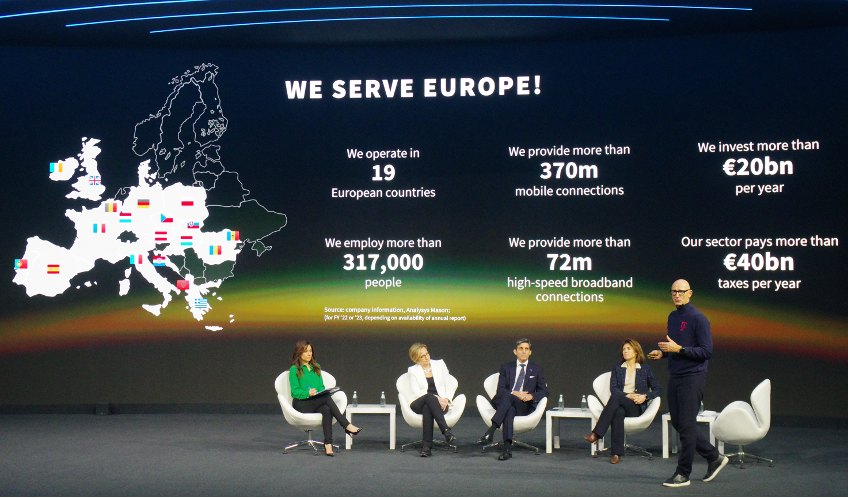

These reports had already highlighted the delicate situation of European operators, but it was decided to take advantage of the celebration of the MWC to further emphasize it. The top executives of the four major European operators made a joint presentation, highlighting that €20 billion is invested annually and double is paid in taxes, providing employment to 317,000 people, as seen in the above picture. Standing in it are Tim Höttges of Deutsche Telekom, and to his right Christel Heydemann of the Orange group, José María Álvarez-Pallete of Telefónica, and Margherita della Valle of the Vodafone group, along with the moderator, Karen TSO of CNBC, wearing a green shirt.

The main message of the joint presentation was that, if drastic and rapid changes are not made in the regulation of telecommunications networks in Europe, there is a serious risk that the old continent will lag behind in technology investment. The basic reason for the alarm of European operators, which the EU Commissioner for the Internal Market, Thierry Breton, does not dispute, is that the financial parameters in which the European telecommunications industry operates are not at all solid.

In fact, Breton also intervened in an individual presentation at the MWC that was not initially scheduled and acknowledged, among other things, that “there are still too many regulatory obstacles to creating a single telecommunications market in Europe” and that “there is no magic number of operators in each country.” A few days earlier, the European Commission had published a green paper with the intention of creating a single telecommunications market in Europe.

The turnover of the European telecommunications sector, measured in average revenue per user (ARPU), is the lowest among all global competitors. In 2022, mobile ARPU was €15 in Europe, compared to €42.5 in the United States, €26.5 in South Korea, and €25.9 in Japan. Fixed-line ARPU was €22.8 in Europe compared to €58.6 in the United States and €24.4 in Japan. Only in South Korea was it lower than in Europe: €13.1, according to the ETNO report.

Return on capital employed (ROCE) for ETNO members has almost halved in recent years: it was 9.1% in 2017 and 5.8% in 2022, making it increasingly difficult to achieve adequate return on investment for European operators. The significant fragmentation of the European telecommunications market exacerbates the situation, the report notes. In 2023, there were 45 major operators in Europe with over half a million customers, compared to eight in the United States, four each in China and Japan, and three in South Korea.

This manifest weakness of the European telecommunications sector was already evident in last year’s ETNO report, which has now been updated. A report published the day before ETNO by the Vodafone Group, titled Why Telecoms Matters, goes in the same direction. For Vodafone, the “connectivity gap” will only widen further if the same path is followed and nothing is done to remedy it.

European operators were hopeful that legislation on gigabit infrastructure (Gigabit Infrastructure Act) being finalized by the European Commission would help correct the situation and address some of the sector’s most serious problems. Last September, a joint statement from ECTA, ETNO, Giga Europe, and the GSMA welcomed the Commission’s proposal for the Gigabit Infrastructure Act, believing it “was intended to tackle the bureaucracy and challenge of slow, complex, and costly deployment of very high-capacity networks (VHCN) in the European Union” and that the situation could thus be rectified.

However, on February 1st, the same four associations that praised the community initiative in September published a new statement warning that there had been a reversal in the draft on key issues and that the cost and deployment of new infrastructures would not be reduced as initially proposed.

In the current negotiations, “there is a risk of introducing measures that penalize telecommunications operators without producing any real benefit in terms of administrative simplification,” their joint statement reads. The “implicit approvals” of deployments that had been included are now without a defined deadline and have regulated prices that are considered completely “aggressive and unjustified.”

European operators have other historical claims, such as large tech companies (Alphabet, Meta, Microsoft, Netflix, Amazon, and Apple, among the most important) bearing all or part of the extra telecommunications traffic they generate in Europe with their services by using European infrastructure. The other major historical demand is for national telecommunications markets to be opened up and for mergers to take place between operators from different countries or the same country.

The latter seems to be somewhat flexible already. The merger between Orange and MásMóvil in Spain and between Vodafone Group and CK Hutchison (Three) in the United Kingdom is well advanced, if no setbacks arise from new demands from state and community regulators. Even if they occur, competition will not improve much anyway. With the merger between MásMóvil and Orange, one operator may disappear, but the previous brands will be maintained, and a new operator will emerge strengthened by the purchase of the remaining merged business, Digi in this case.

Triple traffic in the next five years

Over the next five years, mobile data traffic will almost triple in Europe, due to the increased capacity of telecommunications networks and the coverage of 5G networks, as stated in The Mobile Economy Europe 2023 from the end of last November by the GSMA, the association that brings together most of the world’s operators. Over the next three years, the number of 5G connections will surpass 4G and represent more than half of the total, accounting for up to 87% by 2030, according to the GSMA report. By the end of this decade, 4G networks will only represent 12% of total connections, and 2G and 3G will be practically negligible, they add.

The increase in mobile networks will make the mobile telecommunications sector more important for the European economy, with the GSMA estimating that its contribution will increase from 910 billion euros in 2022, 4.3% of the European GDP, to one trillion euros in 2030. But for digital transformation in Europe to be truly effective and for there to be competitive fixed and mobile telecommunications networks in Europe, it is necessary for European operators to be in good health.

Thus, the GSMA aligns with the demands of European operators and also calls for a “fair contribution” from major Internet traffic generators to operators, thereby benefiting European users. In the report, the GSMA criticizes the European Declaration of Digital Rights and Principles from December 2022 because, although it places consumer rights at the center, it does not automatically set an extra charge for major Internet traffic generators, but states that “all market players benefiting from digital transformation should make a fair and proportionate contribution to the cost of public goods, services, and infrastructure.”

Critics of this generic declaration argue that it would not be fair for some companies to pay because their content represents a significant portion of traffic, as some, like consumers in general, have already paid for it. The “fair” contribution of major tech companies, therefore, is a subject of intense dispute and repeated complaints from operators. The issue is very thorny because it is also true that increased traffic does not necessarily mean higher costs for operators.

Meanwhile, years go by and the European telecommunications sector is losing competitiveness against the rest of the world, especially against China, which sees 5G networks and, above all, SA 5G networks (those that are independent of 4G networks and allow access to the great advantages of 5G) skyrocket. In this edition of the MWC, the first 5G Advanced networks will be presented, which will begin to be deployed next year. It is an update in the middle of the decade that already happened with 4G and 3G. China and South Korea are already working on it, while Europe and the United States still have to seriously install SA 5G networks (now they are looking for an intermediate path with cloud-based 5G access networks, or Cloud RAN).

According to Ericsson’s updated report from last November, as seen in the table below, China had 769 million 5G connections by the end of 2023, compared to 260 million in North America and 139 million in Western Europe. In India, there are almost as many 5G lines as in Western Europe (130 million). And by 2029, Ericsson estimates that China will have almost more 5G connections (1.480 billion) than the entire combination of America and Europe (1.590 billion). And this is despite Ericsson forecasting exponential growth in 5G networks in Central and Eastern Europe and throughout South America in the coming years.

Source: Ericsson Mobility Report (EMR), November 2023

Another problem arises from the difficult situation facing the traditional European radio access network (RAN) suppliers, Nokia and Ericsson, who are forced to make new and drastic job cuts in the coming months (Nokia, between 9,000 and 14,000 by 2026; Ericsson, 8,500) due to lack of orders. Both companies cannot rely on the powerful Chinese and Asian markets, as a result of the European and American bans on Huawei and ZTE; India, which had placed many orders with Ericsson, has abruptly halted them.

This forces Nokia and Ericsson to focus solely on the relatively small markets of the United States and Western Europe and to snatch orders from each other, such as the $14 billion order that AT&T has placed with Ericsson to supply “open” cloud 5G networks until 2026, leaving Nokia in the lurch, as it was AT&T’s main supplier. For Nokia’s CEO, Pekka Lundmark, AT&T’s decision to switch to Ericsson is not technological but strictly economic, as the Swedish company has offered particularly favorable conditions and, moreover, AT&T wanted to have a single network supplier. Until now, Nokia had one third and Ericsson two thirds of AT&T’s networks, so Nokia had a tough time, experts acknowledge.

The growth of 5G connections worldwide, which according to the GSMA will increase from 1.6 billion to 2.1 billion between the end of 2023 and the end of 2024, will make the “monetization” of 5G, that is, achieving higher revenues from the sale of 5G services by operators, more important than ever. “Operators will need to focus on enhanced connectivity, through fiber and 5G networks, to accelerate revenue growth with expanded connectivity and digital services beyond their traditional telecommunications services.”

This, adds the global representative of operators, can only be achieved with innovation in networks that balances investments with returns on these investments. Another lever, especially for European operators, will have to come from mergers and acquisitions, provided that national and community regulatory bodies do not impose draconian conditions, as has typically been the case so far. EU policymakers are aware of how much is at stake, but also that there is not much room for maneuver.

Stay up to date about everything

Subscribe to stay up to date with the latest content from Mobile World Capital Barcelona.