Albert Cuesta, Journalist

The chip market is set to set a new record in value this year, although the final dollar figure will depend on whether investments in AI data centres continue to soar.

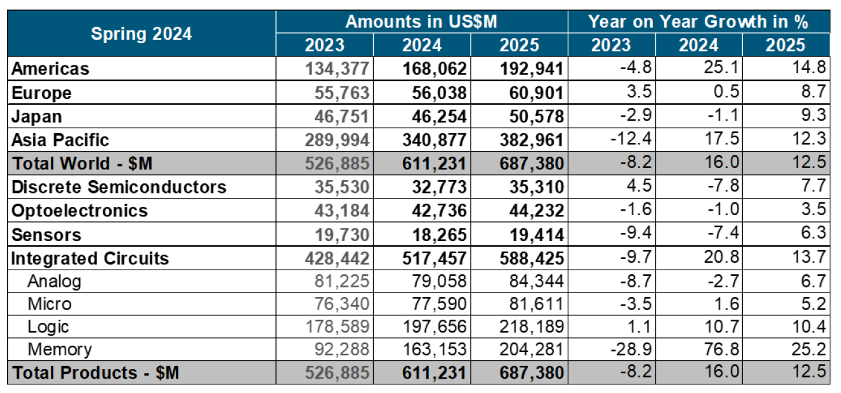

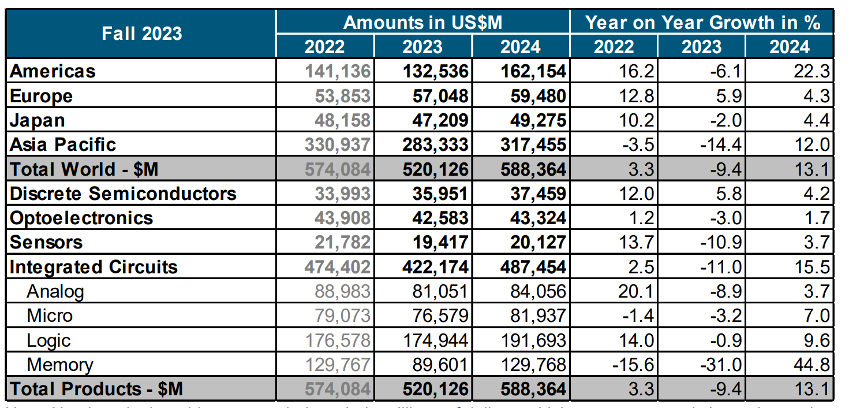

The global semiconductor market is expected to grow by around 16% in value this year, according to the World Semiconductor Trade Statistics (WSTS) forecast of last June, which already revised upwards that of November last year of 13.1%. In this way, the fateful 2023 is left behind, when turnover finally fell by 8.2%, one of the highest in the history of the sector. This is once again a new record for the value of chips expressed in dollars, with an expected turnover of 611,231 million dollars during 2024, compared to 526,885 million in 2023 and 574,084 million in 2022.

By 2025, the WSTS estimate is 687,000 million, 12.5% more and a new record if it is finally achieved, although this growth would have to be maintained until the end of the decade to achieve the trillion-dollar goal advocated four years ago in the midst of market euphoria that finally did not materialize. Precisely, since the end of July, uncertainties have returned in the global semiconductor market, due to the fact that the large investments made in data centres for artificial intelligence (AI), supported by the rise in the value of the shares of large technology companies and Nvidia, have not materialized and it is beginning to be feared that the benefits of AI are greatly overvalued. During August, uncertainties have continued, but the month has ended with increases in most shares of technology companies.

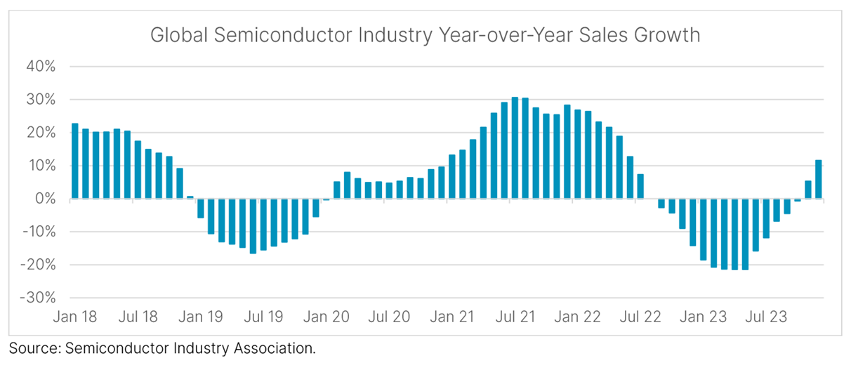

The semiconductor market has always been highly cyclical in its more than half-century history, typically with about three years of growth followed by another three years of recession, with year-on-year increases of up to 30% and declines of 20%. In the last two years, however, the fall in the global market has been much sharper than expected, mainly due to the collapse in the price of memories. Precisely, the main cause of the expected growth of the market for this year and next is due to the exorbitant increase in the price of memory, as well as of the graphics chips for AI sold almost exclusively by the firm Nvidia.

The World Semiconductor Trade Statistics (WSTS) is a non-profit organization founded in 1986 which brings together the vast majority of semiconductor manufacturers, with semi-annual estimates of the market value of the following year by regions and types of products, which have always been highly respected but lately, precisely because of the great volatility of the price of chips, they show large differences from semester to semester, as can be seen below in the Autumn 2023 and Spring 2024 forecast table.

From mid-2022 until the last quarter of last year, the falls in turnover have been significant and higher than expected, of more than 20% for several months, as the graph below indicates.

The main boost to the semiconductor market, and therefore memory, will not come now from smartphones and computers, although it will certainly help, but from the rise of data centres, thanks to generative artificial intelligence (IAGen) platforms and the cloud-hosted programs and data of major technology companies, especially Microsoft, Google, Meta, Amazon, Apple.

As can be seen in the table above, integrated circuits account for the bulk of semiconductors, made up of analogue circuits, microprocessors, logic circuits and memories. The first three types of integrated circuits registered a drop during 2023, but were much less pronounced than memories and, in addition, they grew quite a bit in 2022. Discrete semiconductors, optoelectronics, and sensors also suffered fewer ups and downs than memories and are expected to remain so in the future.

By country blocks, Asia Pacific continues to dominate turnover, although in 2023 it suffered a sharp decline. The American market is expected to grow a lot this year, but it will still have a turnover of half that of Asia Pacific. Europe has maintained sustained growth in recent years, although its turnover is still low, at 60,000 million dollars. Japan, as seen in the table, is expected to stand at $50 billion this year, slightly more than in 2022.

What happened in 2023 has had a strong impact on the turnover of the main semiconductor companies, which are not necessarily chip manufacturers but sell under their own brands, such as the paradigmatic cases of Qualcomm, Nvidia, AMD or Apple. All of them design their chips, but they commission the manufacture of them to a third party, typically the Taiwanese TSMC. The sharp drop in the price of memory has caused a decline in turnover in 2023 for Samsung and SK Hynix, the main Korean memory manufacturers, although it has also made a deep dent in Qualcomm’s results due to the fall in the smartphone market and Intel and AMD due to lower computer sales.

Thus, as seen in the table below, Intel regained first place as the company with the highest turnover in semiconductors in 2023, to the detriment of Samsung, which became the second. Both, however, suffered sharp drops in turnover, with 17% Intel (for computers) and 37% for Samsung (for smartphones and memory). Qualcomm also had much lower turnovers, 17%, although it remained in third position. The one who climbed the most positions was Nvidia, from twelfth to fifth position, with a 56% increase. Its stock market price grew much more and is now worth more than two trillion on the stock market, like Google.

SK Hynix was another of the big losers due to the price of the memories, going from fourth to sixth position. In this first quarter of the year, both Samsung and SK Hynix have grown a lot in profits and turnover, precisely because of the rise in the price of memory in recent weeks. Broadcom and ST Microelectronics performed very well last year, with the former products for telecommunications and the latter, especially for automotive and industrial equipment. The overall drop in turnover of the top ten semiconductor companies – which account for 50% of total turnover – was 11%, with a slight variation in the percentage.

For this year, as indicated, there is a consensus among the large consulting firms that the turnover of the global semiconductor market will grow by double digits, although with quite a few variations: Gartner, Techinsights and IDC, among the best-known, are at the top, from 17% to 20%, while WSTS predicted an increase of 13.1% in November. Deloitte also endorses this relatively prudent increase. In the forecasts of the last two years, all estimates were overly optimistic, as is often the case when the market falls.

Stay up to date about everything

Subscribe to stay up to date with the latest content from Mobile World Capital Barcelona.